News

AutoWallis closed the first quarter by more than doubling its results

2023.05.26.

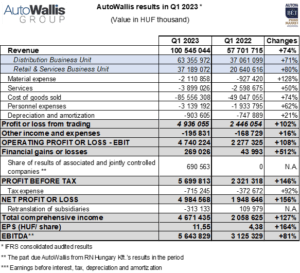

The AutoWallis Group closed Q1 2023 with revenue of more than HUF 100 billion and earnings per share of HUF 11.5, meaning it is continuing down the path of growth that it had previously shared with its shareholders in its published strategy.

Year-on-year, the Group’s revenue has grown by 74%, its EBITA by 81%, and its net profit by 156% in the first three months of the year. The growth is attributable to both organic factors and acquisitions.

The revenue of the AutoWallis Group, present in 15 countries in the region, has increased by 74 percent to HUF 100.5 billion in the first quarter, meaning the Group continues to enjoy sales figures far above Hungarian and European market averages: compared to the same period last year, it sold 86 percent more vehicles in the first quarter, for a total of 13,800. In addition to transaction effects, organic growth also played an important part in these excellent results, mainly driven by the substantial increase in the Distribution Business Unit’s SsangYong and Opel sales, with the Retail & Services Business Unit also seeing growth of HUF 16.5 billion (in both volume and price effect). The Distribution Business Unit’s revenue increased by 71 percent and the Retail & Services Business Unit’s grew by 80 percent. Within costs, the value of cost of goods sold (CoGS) grew by 74 percent to HUF 86 billion, which is equal to the company’s revenue figures, leading to AutoWallis Group’s margin remaining at the same high value as in the base period of 14.9 percent. The value of contracted services grew by 50 percent, primarily due to the greater volume and increased costs of logistics activities connected to the growth in sales (Opel, SsangYong). The 62 percent increase in personnel expenses was caused primarily by increased staff numbers related to the organizational development and by wage increases implemented to keep pace with changes on the labour market, as well as the expansion resulting from acquisitions (the Group’s average headcount increased by 201 to reach 912 persons). In Q1, the value of financial gains or losses was HUF 269 million in profits, which is an improvement of more than HUF 225 million.

The excellent figures of AutoWallis’s first quarter are backed by a quicker-than-planned realization of the growth strategy, which is advantageous both in terms of results and profitability: AutoWallis’s EBITDA increased by 81% in the first quarter to reach HUF 5.6 billion. All in all, the EBITDA margin grew from 5.4 to 5.6 percent: the Distribution Business Unit’s margin grew from 5.4 to 6 percent and the Retail & Services Business Unit’s margins dropped from 5.4 percent to 4.9 percent. This latter decrease reflects and forecasts the margin normalization process that has started in the industry as inventories are being replenished. Thank also to the HUF 691 million in the profits of Renault Hungária, 50 percent of which was purchased by the company, AutoWallis’s net result increased two and a half times to reach HUF 5 billion. AutoWallis’s total comprehensive income was HUF 4.7 billion (+127%), meaning earnings per share (EPS) reached HUF 11.5 in the course of 3 months (the total annual value was HUF 19.27 in 2022).

In connection with the strong start at the beginning of the year, AutoWallis CEO Gábor Ormosy said the exceptional Q1 results and the successfully completed transactions give rise to hope that the Group may close yet another record year in 2023, though the possibility of inflation, increased financing costs, and an economic downturn urge industry players to be cautious. He also added that these may catalyze the consolidation process that has already begun, which AutoWallis, with its stable capital and financing, wishes to utilize in the implementation of its growth strategy.

Latest news

Number of voting rights, composition of share capital 31.01.2026

2026.02.02.

Four analysts recommend AutoWallis shares for purchase with a consensus target price of HUF 200

2026.01.27.

AutoWallis opened the first NIO dealership in Hungary

2026.01.23.

Mobility Perspective 2026: Market outlook and AutoWallis brands’ plans for the Slovenian automotive market

2026.01.22.

Sales Report Q1–Q4 2025 – AutoWallis accelerates in 2025: sales picked up across all business units in the final months

2026.01.15.