News

More than HUF 360 billion in revenue and dynamic growth in profits at the AutoWallis Group in 2023

2024.02.29.

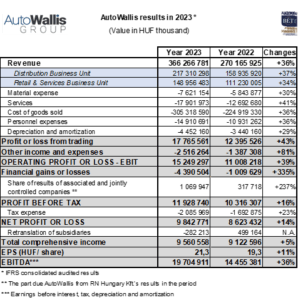

With the AutoWallis Group’s revenue of HUF 366 billion in 2023, the car sales and mobility service provider operating in 16 countries in the Central and Eastern European region and representing 23 brands has closed yet another record year. Last year, revenue saw an increase by 36% with a similar jump in EBITDA to HUF 19.7 billion. Regarding the results, AutoWallis CEO Gábor Ormosy explained that the Group’s unbroken dynamic development can be attributed to its consistently implemented growth strategy, in which expansion is supported by acquisitions in addition to organic growth. He pointed out that the company carried out acquisitions mainly in the area of services (fleet management and car-sharing, among others) while also recognising the expansion of Asian manufacturers and being among the first to enter into partnerships with Chinese brands such as BYD and MG. He added that the fact that close to 60% of revenue originated from international markets and that Opel has extended the Group’s wholesale contract for four countries in the CEE region are a good indication of AutoWallis’s increasingly strong position in the region.

The AutoWallis Group’s revenue increased to HUF 217.3 billion (+37%) in its Distribution Business Unit and to HUF 149 billion (+34%) in its Retail & Services Business Unit. Of the two business units, the Distribution Business Unit saw the greater increase, which grew the number of vehicles sold by 57.6% to reach a total of 34,943. Despite of the disadvantageous environmental environment, the Retail & Services Business Unit, which operates primarily in Hungary, sold 7,907 new (+8,1%) and 2,059 used (+13.4%) vehicles. The company’s market-exceeding performance clearly illustrates that the brand diversification that plays a major part in the strategy leads to growth even in a year when the number of passenger cars placed on the market in Hungary decreased by 3.4%*, while the number of new passenger vehicles registered in the CEE markets relevant to AutoWallis increased by an average of 11.6% year-on-year.* The services offered by the Retail & Services Business Unit also continued their expansion in both repairs and short-term rentals: in addition to a 9.7% growth in the number of service hours, Sixt, which is represented by AutoWallis in Hungary, also increased the number of rental events by 5.4% with an 11.2% drop in rental days. Thanks to the acquisition of Nelson Flottalízing Kft. at the beginning of last year followed by the purchase in August of Wallis Autómegosztó Zrt., which operates wigo (formerly Share Now) in Hungary, the mobility service vehicle fleet is four and a half times larger, which allowed the Group to serve client needs with a total of 3,979 vehicles last year.

AutoWallis’s EBITDA increased by 36% to reach HUF 19.7 billion, which is proportionate to the more than one-third growth in revenue, maintaining last year’s high margin level of 16.6%. Similarly to revenue, the value of cost of goods sold (CoGS) grew by 36% to HUF 305.3 billion. The 36% increase in personnel expenses is primarily attributable to the acquisitions of the past two years and the resulting growth in average staff numbers (which increased by 123 to reach 983 persons in 2023). After the previous year’s figure of HUF -1 billion, the value of financial gains or losses was HUF -4.4 billion in 2023, caused mainly by increases in the interest environment, in financing volumes due to acquisitions, and a substantial jump in financing expenses related to business as usual. As a result of these effects, the company’s total comprehensive income grew to HUF 9.6 billion (+5%) with earnings per share increasing to HUF 21.3 (+11%). AutoWallis Chairman Zsolt Müllner added that since a number of points in the growth strategy announced when the company was listed 5 years ago and then revised with higher figures in 2021 have been outperformed, the company is expected to again revise, in the first half of the current year, the previously set sales and finance targets.

* Market data by ACEA.

Investor presentation – Results for 2023

More than HUF 360 billion in revenue and dynamic growth in profits at the AutoWallis Group in 2023

Latest news

AutoWallis Group’s revenue increased by 20% in 2025, with international markets accounting for an increasing share

2026.02.27.

Tibor Veres wins EY ‘Entrepreneur Of The Year’ award in Hungary

2026.02.23.

Number of voting rights, composition of share capital 31.01.2026

2026.02.02.

Four analysts recommend AutoWallis shares for purchase with a consensus target price of HUF 200

2026.01.27.

AutoWallis opened the first NIO dealership in Hungary

2026.01.23.