News

Retail sales drive the AutoWallis Group’s record Q3 revenue

2024.11.15.

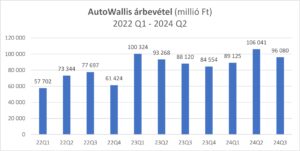

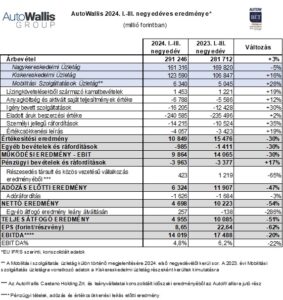

The AutoWallis Group achieved record Q3 revenue, the main driver of which continues to be the Retail Business Unit with its above market average growth of 16%. The revenue of the Group, present in 16 countries in the region, grew to HUF 291 billion and its EBITDA topped HUF 14 billion.

The AutoWallis Group increased its revenue to HUF 291.2 billion (+3%) in the first nine months while the HUF 96 billion revenue seen in the third quarter was 9% higher year-on-year. The fact that almost 60% of this year’s revenue was generated abroad illustrates the Group’s increasing role in the region and the diversification of its operations. Growth was driven by the major regional car sales and mobility service provider’s Retail Business Unit, which increased its revenue by 16% to reach HUF 123.6 billion. The excellent result is primarily due to the importer campaigns of the first quarter focused primarily on Japanese brands, the introduction of the BYD brand at the end of last year, the acquisition of the three Czech Stratos Auto BMW dealerships closed at the end of July, and the opening of AutoWallis’s Renault and Dacia dealership in Budapest (the acquisition and the two new dealerships added 6% to the growth in the number of new units sold). The unit’s performance exceeded the Hungarian market average in the first nine months as well: the organic growth of new vehicle sales was 13.7% even though the growth on the retail markets relevant to the Group, namely the Hungarian and Slovenian markets, was less, at 7.3% and 6.8%, respectively.* The revenue of the Distribution Business Unit amounted to HUF 161.3 billion, which was better than the 9% drop seen in the half-year results and was only a 5% decrease year-on-year. Compared to the third quarter of the previous year, it sold a comparatively similar number of vehicles (-0.8%), which is less than the decrease in revenue. This can be explained by a change in the composition of sold vehicles: although sales of the Renault and Dacia brands increased, this is not present in the Group’s revenue (these brands are sold by RN Hungary Kft., which is not fully consolidated in the Group’s financial statements), and the number of units sold by other brands decreased in the same period. The revenue generated by the Distribution Business Unit has seen an improving tendency since Q2: the reason for the temporary decrease was primarily technical in nature, explained by both the base effect of the exceptionally high sales of previous periods (2022 Q4 and 2023 Q1 and Q2) as well as the extended maritime shipping deadlines in the first half of the year caused by the Suez Canal and the Red Sea situation. Although these one-off effects have now been balanced out, the transport issues may continue to cause delays extending between the quarters despite the fact that order volumes exceeded the planned quantities. AutoWallis’s Mobility Services Business Unit increased its revenue by 26 percent to HUF 6.3 billion in the first nine months of the year.

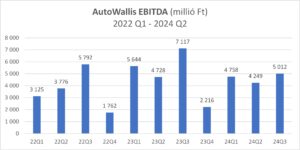

In the first three quarters of 2024, primarily due to the one-off base effects affecting revenue, AutoWallis Group’s EBITDA decreased by 20% to reach HUF 14 billion while its EBITDA margin dropped from 6.2% to 4.8%, higher than the half-year value of 4.6%. Similarly to revenue, the cost of goods sold (CoGS) increased by 2 percent to reach HUF 240.6 billion, which shows the Group was able to increase its high gross margin level from 16.4% in the base period to 17.4%. The 35% increase in personnel expenses is primarily attributable to the growth in staff numbers due to acquisitions carried out in 2023 and already closed in 2024, and to wage increases carried out in keeping with the trends of labor market changes (the Group’s average headcount increased by 226 to reach 1181 persons in the first nine months). In the first three quarters of 2024, the value of financial gains or losses was HUF -4 billion after last year’s losses of HUF 3.4 billion. The increase is mainly due to a transactional increase in financing volume (wigo carsharing vehicles) and realized and unrealized exchange gains and losses (changes in the HUF/EUR exchange rate) from the revaluation of foreign currency items during the period.

Evaluating the results of the first three quarters, AutoWallis CEO Gábor Ormosy said that those are in line with expectations and the updated strategic targets presented this spring. He added that the challenges faced by vehicle manufacturers (changes in CO2 quotas, temporary difficulties involving electrification, the forging ahead of Chinese brands), manufacturing overcapacities, and disadvantageous exchange rates may have a temporary negative effect on car trading companies in the coming period. He also pointed out that in the current macroeconomic environment, AutoWallis continues to count on seeing sales data that substantially exceed last year’s figures, meaning the Group may close 2024 with record revenue figures yet again, and that current forecasts indicate that the difficulties experienced by the market do not threaten the realization of the strategy.

* Market data by ACEA.

* Starting from 2024, mobility-related services such as short and long-term vehicle rentals, fleet management, and car sharing have been moved to a new business unit since their importance grew in part due to the acquisitions (of wigo fleet, formerly Nelson Flottalízing and wigo carsharing) closed in 2023. The data pertaining to the Mobility Services Business Unit had previously been reported as part of the Retail Business Unit.

AutoWallis_reporting-tables_24Q3

autowallis_sajtokozlemeny_2024_Q3_eredmeny_241115_en

Latest news

AutoWallis Group’s revenue increased by 20% in 2025, with international markets accounting for an increasing share

2026.02.27.

Tibor Veres wins EY ‘Entrepreneur Of The Year’ award in Hungary

2026.02.23.

Number of voting rights, composition of share capital 31.01.2026

2026.02.02.

Four analysts recommend AutoWallis shares for purchase with a consensus target price of HUF 200

2026.01.27.

AutoWallis opened the first NIO dealership in Hungary

2026.01.23.