News

The AutoWallis Group’s regional growth strategy plans to again double figures by 2028

2024.05.06.

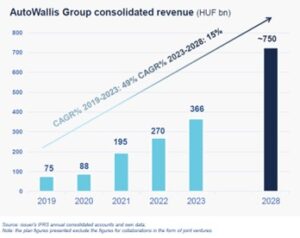

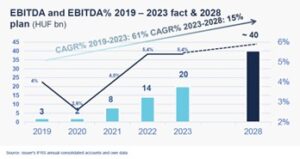

The AutoWallis Group plans to realize revenue of HUF 750 billion and EBITDA profits of HUF 40 billion in 2028, meaning both indicators may be twice that of last year’s results. The major vehicle trading company and mobility service provider in the region representing 24 vehicle brands in 16 countries is planning another 2-3 acquisitions per year in the coming period, and management intends to make a recommendation for the payment of dividends after 2026 following this intense period of growth.

In its updated strategy containing the company’s revised growth figures and dividend payment plans, the AutoWallis Group plans to double its revenue and profits by 2028 while continuing international growth. The move comes after the vehicle trading company and mobility service provider exceeded its 2025 targets for several financial indicators last year. Since it was listed in 2019, the AutoWallis Group has seen enormous growth: its revenue has quadrupled, and its profits have increased tenfold thank to its consistently executed strategy. AutoWallis Chairman Zsolt Müllner pointed out that the Group’s expansion in the past five years was mainly transactional, while even its organic growth surpassed industry trends. Since 2019, AutoWallis, a major player at the regional level, has raised HUF 48 billion from the capital market, increased the number of brands it represents from 9 to 24, carried out 11 acquisitions, and expanded its operations to include 16 countries. Zsolt Müllner emphasized that thanks to the exceptional growth trends AutoWallis has produced in past years, it has expanded to become an international group: more than half of its revenue is permanently generated abroad. The company realized this growth in the midst of economic challenges such as the COVID epidemic, the supply chain difficulties affecting the vehicle manufacturing industry, and the high inflation environment coupled with ever-increasing financing. As a result of its effectively diversified portfolio of brands and countries as well as its consciously pursued strategy, the AutoWallis Group’s growth has remained crisis-proof throughout. Thanks to its continuous growth, the company listed in the Prime Market of the Budapest Stock Exchange has levelled up in all areas; accordingly, AutoWallis expects to garner increased interest among international investors in the coming period, noted the company Chairman.

In its updated growth strategy, AutoWallis expects revenue to more than double last year’s figures to reach HUF 750 billion by 2028, with a similar increase in EBITDA profits and results before taxes, which are expected to reach HUF 40 billion and HUF 25 billion, respectively. AutoWallis CEO Gábor Ormosy highlighted that the company plans to realize growth while continuing to improve operating effectiveness. In the five-year period, the company plans to continue to carry out 2-3 acquisitions annually in addition to its organic growth while also aiming to expand its retail portfolio in the countries it currently covers with as many as possible of the brands it already represents. In its strategy, AutoWallis continues to aim to expand in the Central and Eastern European region while also working on growing the number of brands it represents, especially emerging manufacturers and brands. Gábor Ormosy said AutoWallis expects the more intensive phase of growth to last until 2026, which will be followed by a normalized growth stage. The company does not plan to increase its capital during this period, instead financing the execution of the strategy using generated profits and other sources, primarily through bonds and banks. On its basis, the company management then plans to submit a proposal to shareholders on a predictable, long-term dividend payment scheme following 2026. In the period ending with 2028, AutoWallis plans to continue strengthening its presence on the capital market, with targets including obtaining its ESG rating, securing additional green financing, expanding analytical coverage, purchasing treasury shares, and adding international institutional investors to the list of shareholders.

The AutoWallis Group’s regional growth strategy plans to again double figures by 2028

Latest news

AutoWallis Group’s revenue increased by 20% in 2025, with international markets accounting for an increasing share

2026.02.27.

Tibor Veres wins EY ‘Entrepreneur Of The Year’ award in Hungary

2026.02.23.

Number of voting rights, composition of share capital 31.01.2026

2026.02.02.

Four analysts recommend AutoWallis shares for purchase with a consensus target price of HUF 200

2026.01.27.

AutoWallis opened the first NIO dealership in Hungary

2026.01.23.