News

Results for 2023 Q1-Q3: In just 9 months, AutoWallis has exceeded last year’s entire revenue and profit figures

2023.11.30.

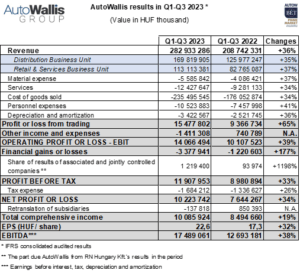

The AutoWallis Group has broken another record, increasing its revenue and profits by more than a third in the first nine months of the year as compared to the same period last year. As a result, the regional vehicle trading and mobility service provider has already surpassed the performance of its entire last year and the company’s earnings per share has jumped to HUF 22.6.

The AutoWallis Group has continued its growth in the first nine months of the year, having exceeded last year’s revenue and profit figures by the end of September. The company, listed in the Prime Market of the Budapest Stock Exchange and present in 16 countries in the region, has seen its revenue increase by 36% to HUF 283 billion, of which 58% was obtained from foreign markets. This performance is especially noteworthy in light of the fact that in the same period, the new vehicle markets of the countries in which the Group is present saw growth of 13%, while Hungary saw a decrease of 3.2%. Regarding the news, AutoWallis Plc. CEO Gábor Ormosy explained that the company’s portfolio of countries, brands, and activities is unique, allowing it to perform well even in the current disadvantageous economic environment. He emphasized the fact that the Group is on a crisis-proof path of growth that has remained steady since AutoWallis was listed on the stock market almost five years ago. As AutoWallis may realize all of the major sales and business targets set in its strategy for 2025 by the end of this year, the targets may be revised in the first half of next year.

In the first three quarters, AutoWallis performed acquisitions in the area of services (Net Mobilitás, Nelson Flottalízing, Wallis Autómegosztó), in addition to which organic growth was also significant, especially the dynamic increases seen in the wholesale of the Opel and SsangYong brands. The revenue of the AutoWallis Group’s two business units continues to show well-balanced growth: the Distribution Business Unit saw an increase of 35% and the Retail & Services Business Unit saw an increase of 37% in revenue. Within costs, the value of cost of goods sold (CoGS) grew by 34 percent to HUF 235.5 billion, which is slightly less than the company’s revenue figures, leading the AutoWallis Group to continue to improve its margin to 16.4% from the base period value of 15.7%. The positive change is primarily thanks to the fact that the Group was able to apply a successful and effective pricing policy in the high inflation environment both in the purchasing and the sale of new and used cars. The value of contracted services grew by 34%, with the 41% increase in personnel expenses due primarily to increases in staff numbers from acquisitions and the increase in wages implemented to keep up with labor market changes (the Group’s average headcount increased by 121 to 954 people). The value of financial gains or losses in the first half was HUF -3.4 billion, which is equal to growth of 177%, driven mainly by the significant increase in the interest environment.

The realization of its growth strategy has also led to an increase in AutoWallis’s efficiency, meaning the rate of its EBITDA growth of 38% surpassed even that of revenue to reach HUF 17.5 billion, which by now significantly exceeds the target value of HUF 14-15.2 billion set for the entire year of 2025 (the EBITDA margin was 6.2%). AutoWallis’s net result was HUF 10.2 billion, which exceeds last year’s similar figures (HUF 7.6 billion) by 34% and also includes 50% of Renault Hungária’s results due AutoWallis (equal to HUF 1.2 billion), with a total comprehensive income of HUF 10.1 billion (+19%). The AutoWallis Group’s earnings per share continued to grow, reaching HUF 22.6 (+32%) in the first nine months of the year, already surpassing the values of all of last year (HUF 19.3).

Download the press release and investor presentation in pdf format:

In just 9 months, AutoWallis has exceeded last year’s entire revenue and profit figures

Latest news

AutoWallis Group’s revenue increased by 20% in 2025, with international markets accounting for an increasing share

2026.02.27.

Tibor Veres wins EY ‘Entrepreneur Of The Year’ award in Hungary

2026.02.23.

Number of voting rights, composition of share capital 31.01.2026

2026.02.02.

Four analysts recommend AutoWallis shares for purchase with a consensus target price of HUF 200

2026.01.27.

AutoWallis opened the first NIO dealership in Hungary

2026.01.23.