News

AutoWallis: Earnings per share almost doubled in the first half

2023.08.31.

The Company published its report for the first half of 2023.

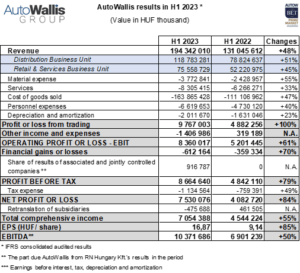

Thanks to the group’s diverse operations and strong growth strategy, AutoWallis closed the first half with results that exceeded the regional and Hungarian car markets. In the first half of the year, the company’s revenue increased by 48%, its net results by 84%, and its EBITDA by 50% year-on-year. As a result, AutoWallis’s earnings per share grew by 85% to reach HUF 17.

The AutoWallis Group closed another strong half, with performance that exceeded the average of not only the Hungarian, but also regional and EU car markets. While the number of new cars registered in the first half of this year on the EU markets relevant to the company listed in the Premium category of the Budapest Stock Exchange showed growth of close to 16%, similarly to the same period in 2022, this same index dropped by 1.5% in Hungary. Contrary to the results of the region’s (and especially Hungary’s) car markets and the disadvantageous processes in the macroeconomic environment, the Group achieved excellent growth in the sale of new and used vehicles, equal to 67%. The organic growth of 27.7% seen in the sale of new cars (in both the Retail & Services and the Distribution Business Units), which surpasses the inflation of the markets in question, is not only significant but also illustrates the strength of the Group’s operations diversified in brands, segments, and geographical areas: as a result, the revenue of the AutoWallis Group, present in 15 countries, grew by 48% to reach HUF 194.3 billion in the first half, more than half of which is permanently generated abroad.

The revenue of the AutoWallis Group’s two business units showed well-balanced growth: the Distribution Business Unit saw an increase of 51% and the Retail & Services Business Unit saw an increase of 45% in revenue. Within costs, the value of cost of goods sold (CoGS) grew by 47 percent to HUF 163.8 billion, which is slightly less than the company’s revenue figures, leading the AutoWallis Group to improve its margin to 15.7% from the base period value of 15.2%. The positive change is primarily thanks to the fact that the Group was able to apply a successful and effective pricing policy in the high inflation environment both in the purchasing and the sale of new and used cars. The value of contracted services grew by 33%, with the 40% increase in personnel expenses due primarily to increases in staff numbers from acquisitions (Nelson, Net Mobilitás) and the increase in wages implemented to keep up with labor market changes (the Group’s average headcount increased by 109 to 930 people). The value of financial gains or losses in the first half was HUF -612 million, which is equal to growth of 70%, driven mainly by the significant increase in the interest environment.

Thanks to the significant increase in revenue and to ongoing improvements in efficiency, the AutoWallis Group almost doubled its earnings per share year-on-year to reach a value of HUF 16.87 (+85%), meaning the growth strategy may be realized faster than planned. AutoWallis’s EBITDA grew by 50 percent to reach HUF 10.4 billion in the first half, with the EBITDA margin remaining at 5.3%, equal to the figure for the same period last year. Together with the HUF 917 million share of the profits of Renault Hungária, 50% of which was purchased by AutoWallis, the company’s net results almost doubled to HUF 7.5 billion, with its total comprehensive income equaling HUF 7 billion (+55%).

AutoWallis CEO Gábor Ormosy remains optimistic regarding the figures of the first half: the acquisitions and transactions carried out by the company in recent years have been successful, and not only have the integrated companies significantly improved the AutoWallis Group’s profit generating capabilities, the growth has also been paired with improvement. The growth that can already be seen in the region may manifest in Hungary in the coming quarters, and the Group is continuing to work on additional transactions and acquisitions.

AutoWallis Group Semi Annual Report 30.06.2023

Investor presentation – Results for 2023H1

Investor presentation – Annexes

AutoWallis: Earnings per share almost doubled in the first half

Latest news

Tibor Veres wins EY ‘Entrepreneur Of The Year’ award in Hungary

2026.02.23.

Number of voting rights, composition of share capital 31.01.2026

2026.02.02.

Four analysts recommend AutoWallis shares for purchase with a consensus target price of HUF 200

2026.01.27.

AutoWallis opened the first NIO dealership in Hungary

2026.01.23.

Mobility Perspective 2026: Market outlook and AutoWallis brands’ plans for the Slovenian automotive market

2026.01.22.