News

The first quarter saw AutoWallis outperforming in retail and the company continues to expect significant growth

2024.04.15.

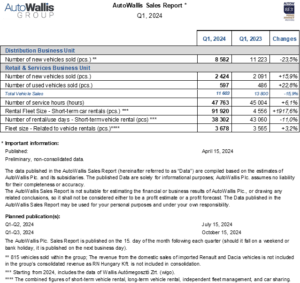

The AutoWallis Group’s Retail & Services Business Unit started the year off strong after increasing new vehicles sales by 16%, substantially exceeding the 7% growth seen on the Hungarian market.

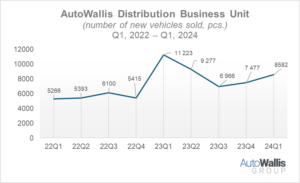

Year-on-year, the number of vehicles sold by the regional car sales and mobility service provider’s Distribution Business Unit was lower primarily due to base effects and the difficulties faced by maritime shipping. As regards services, the number of service hours and rental events increased. All in all, AutoWallis expects this year’s sales data to significantly exceed last year’s figures in light of the current macroeconomic environment.

The AutoWallis Group’s Retail & Services Business Unit increased its new vehicles sales by 15.9% to 2424 units and its used car sales by 22.8% to 597 in the first quarter. This performance is especially worthy of mention in light of the fact that in the same period Hungary saw a 7.23% increase* in the number of registered vehicles. Within the Retail & Services Business Unit, services saw a 6.1% increase in service hours to reach 47,763 hours, with the number of rental events growing significantly, to 91,920, thanks to the acquisition of wigo car sharing last year. The fleet of Sixt, operated by AutoWallis in Hungary, was reduced by 423 vehicles in the first three months of the year in line with seasonal effects; however, due to wigo’s 536 units the total fleet size increased by 113 vehicles to reach 3678 (+3.2%). The 11% decrease in rental days can also be considered seasonal, which, paired with the reduction in fleet size, also means an improvement in operating efficiency. Due to one-off and substantial base effects in the Distribution Business Unit, the number of new vehicles was 23.5% lower, equal to 2641 vehicles. The reason for the decreased sales volume is technical in nature, explained by the exceptionally high figures in the last quarter of 2022 and the base period – the first quarter of 2023 – as well as the Suez Canal and the Red Sea situation in the first quarter of this year, which extended maritime shipping deadlines by almost a month. As previously indicated by AutoWallis, last year’s increased registration figures were a result of the deferred purchases due to COVID, the chip shortage, and global shipping difficulties coupled with a large backlog of orders waiting to be fulfilled. These one-off effects have now been balanced out, and sales are normalizing and levelling out, once again becoming more predictable. The decrease was primarily due to the lower sales volumes of SsangYong (-1709), Dacia (-462), and Opel (-287) vehicles. AutoWallis CEO Gábor Ormosy explained that the Distribution Business Unit also performed in accordance with expectations, and emphasized that as regards the forecast for 2024, they expect to see growth compared to the base period already in the upcoming quarter thanks to the current macroeconomic environment, meaning the number of vehicles sold by the two divisions may see significant increases.

Latest news

The AutoWallis Group’s regional growth strategy plans to again double figures by 2028

2024.05.06.

Investor Day Reminder

2024.05.03.

AutoWallis publishes its third Sustainability Report

2024.05.02.

Number of voting rights, composition of share capital 30.04.2024

2024.04.30.

Resolutions of the general meeting

2024.04.26.