News

MBH: target price for AutoWallis shares upped to HUF 225 with a buy rating

2025.03.13.

In its newest analysis, MBH Investment Bank upheld its buy rating and increased the 12-month target price for AutoWallis Plc. shares from HUF 223 to HUF 225. Prior to the MBH’s step, two other analyst houses covering the region’s major vehicle trading and mobility service provider, Concorde Értékpapír Zrt. and OTP Bank, also increased their target prices for AutoWallis’s shares.

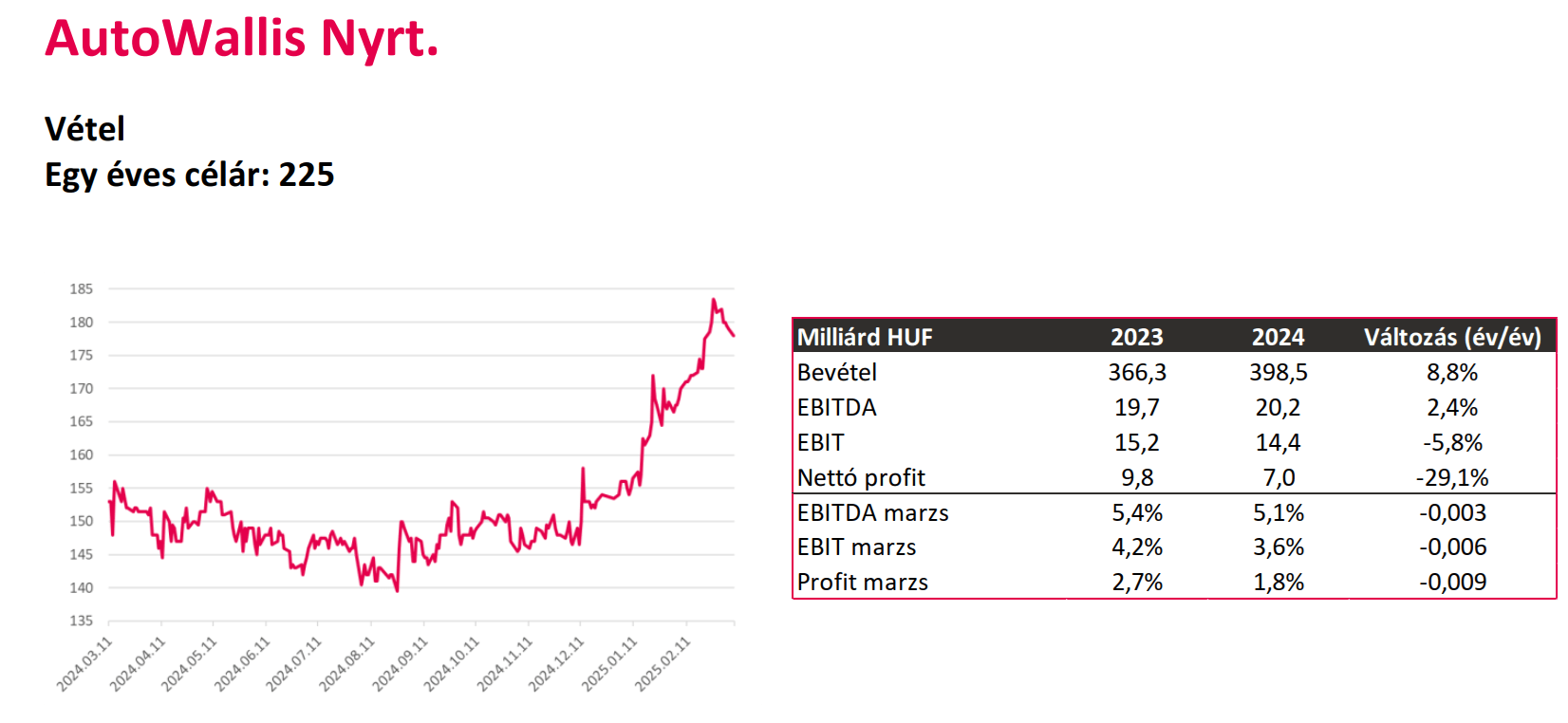

MBH Investment Bank updated its analysis of AutoWallis Plc.’s shares, maintaining its buy rating for AutoWallis shares with a (12-month) target price of HUF 225. MBH Investment Bank starting covering AutoWallis’s shares in September 2024 with a HUF 223 12-month target price and a buy rating. All three of the analyst houses that cover the AutoWallis Group have recently updated their analyses of the group representing 27 brands in 16 regional countries: Concorde Értékpapír Zrt. increased the 12-month target price for the automotive company registered on the Hungarian stock exchange from HUF 230 to HUF 235, while OTP Bank’s increase was from HUF 180 to HUF 210. The analyst houses released their updated analyses after the region’s major integrated vehicle trading company and mobility service provider published its 2024 results, which showed a 9% increase in revenue to HUF 398 billion with an EBITDA figure of HUF 20.2 billion last year, meaning the figures reported by AutoWallis either met or exceeded analyst expectations.

Concorde Értékpapír Zrt. – 12-month target price: HUF 235; Rating: buy; Analysis

MBH Investment Bank – 12-month target price: HUF 225; Rating: buy; Analysis

OTP Bank – 12-month target price: HUF 210; Rating: buy; Analysis

Latest news

AutoWallis Group’s revenue increased by 20% in 2025, with international markets accounting for an increasing share

2026.02.27.

Tibor Veres wins EY ‘Entrepreneur Of The Year’ award in Hungary

2026.02.23.

Number of voting rights, composition of share capital 31.01.2026

2026.02.02.

Four analysts recommend AutoWallis shares for purchase with a consensus target price of HUF 200

2026.01.27.

AutoWallis opened the first NIO dealership in Hungary

2026.01.23.