News

AutoWallis revenue up by 20% in the first quarter, almost two-thirds of which is now generated abroad

2025.05.19.

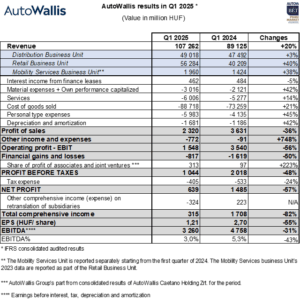

Despite a volatile macroeconomic environment, AutoWallis Group increased its revenue by more than 20% to reach HUF 107 billion in the first quarter while the company’s EBITDA dropped to HUF 3.3 billion, primarily because of the unfavorable operating environment. This record revenue was primarily driven by recent acquisitions and business development initiatives.

AutoWallis is continuing to execute its growth strategy, exploring new opportunities for acquisition and business development in the region, and focusing on improving operational efficiency while exploiting the possibilities afforded by synergies in earlier transactions.

The revenue of AutoWallis Group, present in 16 countries in the region and representing 27 brands, grew by 20% to reach HUF 107 billion in the first three months of the year, setting a new record. Growth is both organic (3%) and is also attributed to the effects of acquisitions and business developments. While European Union markets saw a 1.9% drop in the sale of new vehicles*, the majority of the region saw growth of 1-4%, typically with stabilizing inflation and economic growth that is slowly trending upwards. The Group sold 1.8% more vehicles in the first three months of this year to reach a total of 11,814. Dealership and importer stocks increased as a result of normalized manufacturing capacities and the slowdown of customer acquisitions seen in certain brands on various Central and Eastern European markets. The company’s EBITDA saw a decline of 31% to reach HUF 3.3 billion, primarily due to the disadvantageous operating environment (e.g. unpredictability of the market impact of tariff measures) and the rise of other fixed costs that promote growth, while earnings per share dropped to HUF 1.21 (-55%) in the first quarter. The Group has efficiency-improving measures in place to offset these effects, the positive effects of which will be felt in the coming period. AutoWallis Group continued to improve its sales performance, though growth was mitigated by the continued normalization of margins, the mainly inflation-driven growth of operating costs, and the effects of wage increases. The fact that 64% of the first quarter’s revenue was generated abroad illustrates the Group’s increasing role in the region and the diversification of its operations.

Year-on-year, the Distribution Business Unit sold 5% fewer vehicles, mainly due to one-off effects, primarily the delayed market introduction of two Opel models (the positive effects of which are expected in the coming quarters). Nevertheless, the Unit increased its revenue by 3% to a total of HUF 49 billion thanks to a change in the composition of sold vehicles and an interim change in prices. A one-off effect also impacted the Unit’s results: it sold, at cost value, 540 vehicles affected by an insurance event, the compensation for which is expected to improve its results in a later period.

The revenue of the Retail Business Unit saw substantial growth to top out at HUF 56.3 billion (+40%), primarily because of the acquisitions and business developments closed in the past period (the acquisition of the Czech MILAN KRÁL GROUP and NC Auto), though revenue would have slightly exceeded that of the first quarter of 2024 even without acquisitions. The Unit sold 2,731 new (+12.7%) and 938 used (+57.1%) vehicles in the first quarter of 2025 – without acquisitions, these numbers are similar to those of the same period last year. Regarding the Retail Business Unit’s services, the growth in the number of service hours was primarily due to acquisitions, with the numbers similar to last year’s identical period even in their absence.

The revenue seen by the Mobility Services Business Unit of the company listed on the Prime Market of the Budapest Stock Exchange grew by 38% to HUF 2 billion thanks to the exceptional first quarter performance of the short-term vehicle rental provider Sixt and the fleet size increase in fleet management services. The number of rental events decreased slightly, by 2.9%, at the Group unit incorporating short and long-term vehicle rental and fleet management activities, though the number of rental days grew by 13.6% thanks to the increase in the percentage of long-term rentals.

In the first quarter of 2025, primarily due to one-off effects, AutoWallis Group’s EBITDA decreased by 31% to reach HUF 3.3 billion while its gross margin remained high and its EBITDA margin dropped from 5.3% to 3%, though this temporary downturn does not affect the realization of AutoWallis’s strategy. Similarly to revenue, the cost of goods sold (CoGS) increased by 21 percent to reach HUF 88.7 billion, which shows AutoWallis was able to retain its high gross margin level (17.3%) at a rate similar to the previous base period (17.8%). The 45% increase in personnel expenses is primarily attributable to the 37% increase in staff numbers as a result of acquisitions (the Group’s average headcount increased by 385 to reach 1423 persons year-on-year) and to wage increases implemented in keeping with the inflation-following changes on the labor market. In the first quarter of 2025, the value of financial gains or losses was HUF -817 million, which reflects expenditure of almost 50% less compared to the 2024 base period. Interest expenses increased mainly due to the acquisition-related loan taken out in the second half of 2024 and the interest on the bond issue carried out last December. AutoWallis accounted for HUF 262 million as realized and unrealized exchange rate gains and losses, compared to HUF 655 million in losses recorded in the same period last year.

Evaluating the results, AutoWallis CEO Gábor Ormosy explained that the manufacturer’s campaigns of the year’s first quarter were less than the exceptional support given last year, and the uncertainty of the global commercial policy measures that have a profound impact on the industry also helped shape the first quarter, though the acquisitions and business developments closed in this previous period had a positive impact on the company’s results. As the company has built up the majority of the acquisition and management competences necessary to execute its growth strategy, its costs impact the target period while the effects of the planned dynamic growth will fully manifest together with future planned transactions. In regard to the outlook, he emphasized that AutoWallis is continuing the implementation of its growth strategy, exploring opportunities for regional acquisitions and business development while also exploiting expansion and synergy opportunities from past transactions.

* Vehicle market data by ACEA.

The AutoWallis Group

AutoWallis Group is building the leading integrated car and mobility service provider in the Central and Eastern European region. It is important for the company to continuously expand its portfolio in automotive retail and mobility services, through organic and acquisition growth and to operate as a classic, conservative group with a business policy in line with ESG values and sensitive to social and environmental challenges. The AutoWallis Group is present in 16 countries of the Central and Eastern European region (Albania, Austria, Bosnia and Herzegovina, Czech Republic, Bulgaria, Croatia, Greece, Hungary, Kosovo, Montenegro, Poland, Romania, Serbia, Slovakia, Slovenia, North Macedonia and Hungary) with wholesale and retail motor vehicle and parts distribution, service, short and long term car rental. Brands represented by the Group’s Wholesale business include Alpine, BYD, Dacia, Isuzu, Farizon, Jaguar, Land Rover, MG, Saab aftermarket, Renault, KGM and Opel, the brands represented by the Retail business include BMW cars and motorcycles, BYD, Dacia, Ford, Isuzu, Jaguar, KIA, Land Rover, Maserati, Mercedes-Benz, Mercedes-Benz Trucks, MINI, Nissan, Opel, Peugeot, Renault, KGM, Suzuki, Toyota, JóAutok, and others. hu, AUTO-LICIT.HU, while the Mobility Services Business Unit is present on the Hungarian market with the brands wigo carsharing, wigo fleet, Sixt rent-a-car.

www.autowallis.com www.facebook.com/AutoWallis

Further information:

| Ádám Kerekes, Financial Communications | Mobile: +36 70 341 8959 | Email: kerekes.adam@fincomm.hu |

Latest news

AutoWallis Group’s revenue increased by 20% in 2025, with international markets accounting for an increasing share

2026.02.27.

Tibor Veres wins EY ‘Entrepreneur Of The Year’ award in Hungary

2026.02.23.

Number of voting rights, composition of share capital 31.01.2026

2026.02.02.

Four analysts recommend AutoWallis shares for purchase with a consensus target price of HUF 200

2026.01.27.

AutoWallis opened the first NIO dealership in Hungary

2026.01.23.