News

AutoWallis’ results in the first half of 2025 show over 20% increase in revenue with improving efficiency

2025.08.18.

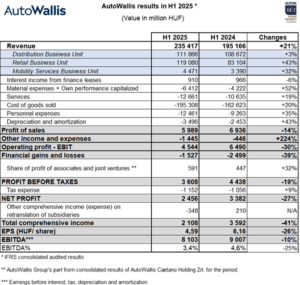

Compared to the first three months of the year, AutoWallis’operating efficiency improved, and its revenue increased by nearly 21% to HUF 235 billion in the first half of 2025. The company’s EBITDA was HUF 8.1 billion, reducing the difference from the comparable period of the previous year to 10%, as opposed to the 31% shortfall in the first quarter. Some of the measures aimed at increasing profitability and efficiency have already contributed to the improvement, with further favorable effects expected later.

The revenue growth was primarily driven by the Retail Business Unit’s revenue, which increased by more than 40%, mainly due to the international acquisitions carried out last year. Following the acquisitions, the company, which represents 29 brands in 17 countries of the region, will continue to seek new acquisition and business development opportunities in line with its growth strategy, in addition to exploiting synergy opportunities.

AutoWallis, listed on the Prime Market of the Budapest Stock Exchange, improved its operating efficiency: its revenue grew by 21% to HUF 235.4 billion in the first half of the year, while its EBITDA reached HUF 8.1 billion. This is only 10% below last year’s figure, while the difference was still 31% at the end of the first quarter. This indicates that the previously announced efficiency-boosting and cost-cutting measures were already successful in the second quarter, while some of their positive effects are expected to materialize later. Gábor Ormosy, CEO of AutoWallis, explained that in the first half of the year, automotive manufacturer campaigns fell short of last year’s outstanding level, which had an unfavorable impact, while previously completed acquisitions had a positive effect on the company’s results. Sales performance continues to show an upward trend, which was somewhat offset in the first six months by the normalization of margins, as well as the increase in operating costs generated by inflation and the effect of wage increases. The CEO emphasized that due to the efficiency-improving and other measures, AutoWallis achieved an almost HUF 600 million higher EBIDTA in the second quarter compared to the same period last year. Regarding retail trends in the automotive industry, he added that while new vehicle sales in the EU decreased by 1.9%*, AutoWallis’ relevant markets were on a growth trajectory of 2–7%, typically accompanied by stabilizing inflation and slowly emerging economic growth. The number of new and used vehicles sold by the company rose by 3.4% to 26.314 units in the first six months of the year.

The Distribution Business Unit achieved a revenue of HUF 111.9 billion, nearly 3% higher than in the previous year’s comparable period, with a 3.7% decrease in vehicles sold (partially due to one-off effects), thanks to a change in the composition of vehicles sold and interim price changes. The continuously strengthening regional role of AutoWallis is demonstrated by the fact that more than half of the Distribution Business Unit’s sales are now generated abroad on a permanent basis. The profitability of the business unit was reduced by the weaker performance of the Opel brand in the first half (partially due to the late start of production of two new models) and one-off effects.

The Retail Business Unit’s revenue increased significantly (+43%) to HUF 119 billion, primarily due to previously completed acquisitions (the takeover of Czech MILAN KRÁL GROUP and NC Auto), while without acquisitions, the business unit’s revenue performed at approximately the same level as the previous year’s comparable period (+4%), with slightly decreased (-4%) vehicle sales. This latter decrease can be explained by the base effect caused by excellent manufacturer campaigns in the previous year’s first quarter for the Suzuki, Toyota, and Nissan brands.

The revenue of the Mobility Services Business Unit of AutoWallis, grew by 32% to HUF 4.5 billion, thanks to the outstanding first-half performance of Sixt, which provides short-term car rental services, as well as the fleet growth achieved in fleet management services.

AutoWallis’EBITDA was HUF 8.1 billion (-10%) in the first half of 2025, while the EBITDA margin decreased from 4.6% to 3.4%. However, due to the implemented efficiency-improving and other measures, the company achieved an EBITDA result in the second quarter of this year that was nearly HUF 600 million higher than in the same period last year, so the temporary slowdown does not jeopardize the realization of the company’s strategy. The cost of goods sold (CoGS) grew at a lower rate than the revenue, by 20% to HUF 195.3 billion, so AutoWallis could realize an increase in its high level of gross margin generation ability from 16.7% in the previous base period to 17%. The 35% increase in personnel expenses is primarily due to a nearly 30% increase in headcount resulting from the acquisitions (the company’s average headcount for fully consolidated companies increased by 362 to 1413 compared to the same period last year), as well as wage increases introduced in response to changes in the labor market. The value of financial income and expenses in the first half of 2025 was HUF -1.5 billion, which represents a 39% decrease in expenses compared to the 2024 base period. Interest expenses primarily increased due to the acquisition-related loan taken out in the second half of 2024 and the interest on the bond issued last December. As a result of realized and unrealized exchange rate differences, AutoWallis realized a profit of nearly HUF 700 million, in contrast to a similar amount of loss in the previous year’s comparable period.

Evaluating the results, Gábor Ormosy, CEO of the AutoWallis Group, said that the figures for the first half were already positively influenced by the effects of acquisitions and business developments completed in the previous period. He added that the company has mostly developed the acquisition and management competencies necessary to implement its growth strategy, so the related costs have already been incurred during this period, while the full-scale impact of the planned dynamic growth would be realized with transactions planned for later. The CEO added that AutoWallis will continue implementing its growth strategy, exploring domestic and regional acquisition and business development opportunities, as well as capitalizing on the expansion and synergy opportunities inherent in previous transactions.

*The automotive market data was provided by ACEA.

Latest news

AutoWallis Group’s revenue increased by 20% in 2025, with international markets accounting for an increasing share

2026.02.27.

Tibor Veres wins EY ‘Entrepreneur Of The Year’ award in Hungary

2026.02.23.

Number of voting rights, composition of share capital 31.01.2026

2026.02.02.

Four analysts recommend AutoWallis shares for purchase with a consensus target price of HUF 200

2026.01.27.

AutoWallis opened the first NIO dealership in Hungary

2026.01.23.