News

AutoWallis Group Investor presentation 2025 Q1-Q3: AutoWallis Group’s revenue up by 21% in the first nine months of the year

2025.11.17.

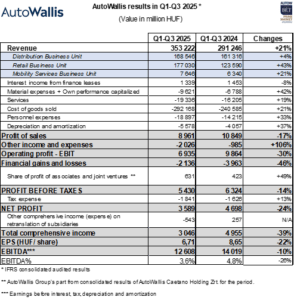

AutoWallis continued to deliver strong performance in the third quarter as well: following the previous trend, the Group, which is present in 17 countries across the region, increased its revenue by 21%, reaching HUF 353 billion. A total of 67% of the revenue originated from foreign markets, while growth was supported by both earlier acquisitions and organic expansion. All three business units performed well: revenue in the Retail Business Unit rose by 43%, followed by the Mobility Services and Distribution Business Units with increases of 21% and 4%, respectively.

The Company’s EBITDA for the first nine months reached HUF 12.6 billion, in line with expectations, providing a stable foundation for the continuation and successful execution of the Group’s growth strategy.

AutoWallis Group’s revenue increased by 21% to HUF 353.2 billion in the first nine months of the year compared to the same period of the previous year, continuing the approximately 20% growth dynamics seen in the first two quarters. Growth reflected both organic expansion (+6.1%) and the impact of acquisitions, while the share of revenue generated outside Hungary amounted to 67% of the total revenue of the Group present in 17 countries of the region. The performance of the European Union and the region covered by AutoWallis remains mixed: while the number of new passenger car registrations in the EU increased by 0.9%, the region served by AutoWallis recorded growth exceeding 6% in the first nine months (with Slovakia and Romania as exceptions, where registrations declined by 0.2–6%).

Among AutoWallis Group’s three business units, the Retail Business Unit demonstrated the strongest growth once again: its revenue rose by 43% to HUF 177 billion, primarily due to acquisitions closed earlier (the purchase of the Czech MILAN KRÁL GROUP and NC Auto), while organic growth was 7.5%. The Distribution Business Unit increased its revenue by 4.5% to HUF 168.5 billion in the first three quarters. The number of new vehicles sold grew by 2.5%, explained by changes in the composition of vehicles sold and interim price adjustments. The Opel brand, recovering from weaker performance in the previous period, achieved a growth of 3.6% in the countries covered by AutoWallis—as opposed to the approximately 10% decline observed in EU markets. At the same time, performance in the business unit was negatively impacted by a 4.4% decline in KGM sales, and these trends combined with lower Jaguar and Land Rover sales due to changes in model mix reduced the Distribution Business Unit’s gross margin contribution. Results were further affected by the inflationary environment and temporary cost increases linked to KGM’s rebranding and introduction of new brands. To improve profitability, AutoWallis has decided on efficiency-enhancing and cost-reduction measures, expected to show their positive impact on results starting in 2026. Revenue in the Mobility Services Business Unit of AutoWallis Group increased by 21% to HUF 7.6 billion, driven primarily by the excellent performance of the rent-a-car segment and fleet expansion.

AutoWallis Group’s EBITDA amounted to HUF 12.6 billion in the first nine months of 2025 (-10%), while the EBITDA margin decreased from 4.8% last year to 3.6%. Due to efficiency-enhancing measures introduced largely in response to rapid growth, the Company achieved an EBITDA nearly HUF 600 million higher in the second quarter than in the same period last year, and was only HUF 500 million lower in the third quarter; thus, the temporary decline visible in cumulative figures does not, according to management, jeopardize the implementation of AutoWallis’s strategy. Cost of goods sold (CoGS) increased in line with the revenue, by 21%, to HUF 292.2 billion, while AutoWallis maintained its ability to generate a gross margin above 17%. Personnel expenses increased by 33%, primarily due to a 22% growth in headcount driven by acquisitions (the average number of employees in the fully consolidated companies rose by 264 to 1,444 compared to the same period last year) and wage increases driven by labor market trends. The value of financial income and expenses in the first nine months of 2025 was HUF -2.1 billion, which represents a 46% decrease in expenses compared to the 2024 base period. Interest expenses primarily increased due to the acquisition-related loan taken out in the second half of 2024. As a result of realized and unrealized exchange rate differences, AutoWallis recognized a profit of nearly HUF 1.4 billion.

Evaluating the results of the first nine months, Gábor Ormosy, CEO of AutoWallis Group, said that the over 20% revenue growth was driven by both organic and acquisition effects. While gross margin generation remained broadly in line with previous levels, AutoWallis delivered lower EBITDA, profit before tax, and net profit than last year, which is consistent with management expectations. At the same time, this does not affect the feasibility of the Group’s previously defined strategic objectives and continues to provide a stable basis for the company’s growth strategy going forward.

Latest news

AutoWallis and Salvador Caetano opened their first XPENG dealerships in two countries

2026.03.02.

Number of voting rights, composition of share capital 28.02.2026

2026.03.02.

AutoWallis Group’s revenue increased by 20% in 2025, with international markets accounting for an increasing share

2026.02.27.

Tibor Veres wins EY ‘Entrepreneur Of The Year’ award in Hungary

2026.02.23.

Number of voting rights, composition of share capital 31.01.2026

2026.02.02.