News

AutoWallis Group closed 2024 with growth and stable profits even in a variable environment

2025.02.28.

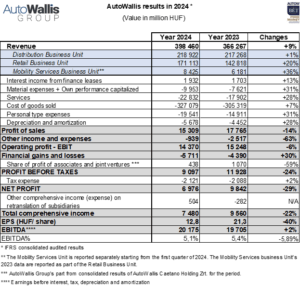

The AutoWallis Group increased its revenue to HUF 398 billion and its EBITDA results to HUF 20.2 billion. Sales were driven by retail, with the discount stocks sold last year because of the EU emission rules that enter into effect this year having a negative effect on the Group’s overall performance and sales margins. AutoWallis is continuing the implementation of its growth strategy in 2025, exploring opportunities for regional acquisitions and business development while also exploiting expansion and synergy opportunities from past transactions.

In 2024 the AutoWallis Group increased its revenue by 9% to HUF 398 billion while the number of vehicles sold grew by 8% to 48,386 units. The Group’s increasing regional role and the diversification of its operations is underlined by the fact that more than 60% of last year’s revenue was generated abroad, which may increase by up to 10 percentage points this year as new foreign markets had figured in only a part of last year. Compared to earlier years, the one-off effects on trade were in general balanced out, with sales taking on a more balanced distribution than in 2023. Sales of the integrated vehicle sales and mobility service provider, present in 16 Central and Eastern European countries and representing 27 brands, were primarily driven by retail sales, with the company’s EBITDA results growing slightly (+2%) to reach HUF 20.2 billion, mainly thanks to the increase in mobility services.

Evaluating the results, AutoWallis CEO Gábor Ormosy explained that 2024 revenue, EBITDA, and earning per share figures were equal to or better than the most current expectations published by Concorde, MBH Investment Bank, and OTP. Assessing market processes, he pointed out that in 2024 the number of new passenger vehicles registered grew by 0.8% on EU markets and between 4 and 14% on the Group’s major markets for an average of 7% compared to the previous year.* The numbers indicate that a substantial part of the region is on a path of growth, with dropping inflation rates and slow economic growth. The CEO went on to say that the regional market showed stable growth in 2024, though manufacturing capacities increased compared to previous years and the customer contracting process slowed in certain markets, leading to an increase in dealership and importer stocks, forcing market participants to provide significant discounts and various other sales incentives. Gábor Ormosy pointed out that the challenges faced by vehicle manufacturers (more stringent CO2 quotas based on the Clean Air for Europe (CAFE) regulation, the temporary issues faced by electrification) had a negative impact on margins in the industry, with the year-end weakening of the HUF also having a negative impact on the group. Regarding expectations, the AutoWallis CEO said that the improving tendencies in financing opportunities have a positive effect on demand in the vehicle market, which may further improve the new and used car market in the coming period, especially in the regions covered by AutoWallis, where market growth potential is higher than in Western European countries. Gábor Ormosy said they will be continuing the implementation of their growth strategy in 2025, exploring opportunities for additional acquisitions and business development while also exploiting opportunities for expansion and synergy from past transactions to continue increasing efficiency.

Revenue of AutoWallis’s Distribution Business Unit amounted to HUF 219 billion in 2024, which, after overcoming the exceptionally high drop compared to the base that kicked off the year, means 1% growth compared to the previous year. Thus, the decrease in the business unit’s sales in the first quarter of last year is attributable to this base effect as well as to one-off events, which the business unit managed to compensate for, selling 1253 more vehicles (+3.6%) on an annual level and 3894 more vehicles (more than +10%) in the last three quarters of the year as compared to the same respective periods in 2023 for a grand total of 36,196 units. The slower rate of growth seen in revenue figures is primarily due to the change in the composition in the vehicles sold, as the most popular models were temporarily unavailable in a number of brands or lower value vehicles were added to the range. Of the brands represented, Renault made the largest contribution to the Group’s growth with 7,001 sold vehicles (+24%); however, Renault and Dacia brand sales are not present in the Group’s revenue (these brands are sold by RN Hungary Kft., which is not fully consolidated in the Group’s financial statements). The Retail Business Unit’s revenue grew to HUF 171 billion (+20%) due to the 22% and 24% increase in new and used vehicle sales, respectively. This outstanding performance is based on AutoWallis’s updated strategy, introduced in 2024: organic growth was strong last year as well, further supported from the second half by the acquisition of three Czech NC Auto (Stratos) BMW dealerships, finalized in the beginning of July (+366 units, + HUF 10 billion), and the sales figures of AutoWallis’s Renault and Dacia dealership opened in Budapest in the fall (+211 units). In addition to highlighting AutoWallis’s regional role, the numbers also show that its diversified portfolio allows for growth surpassing the rate of the domestic market (+12.9%**). In 2024, AutoWallis’s Mobility Services Business Unit*** increased its revenue by 36 percent to HUF 8.4 billion. For the most part, the growth is attributable to a transaction effect (wigo acquisition) and the significant growth of its short-term rental activity (Sixt), while fleet management services remained stable.

Primarily due to the one-off base effects affecting revenue, the AutoWallis Group’s 2024 EBITDA showed only a slight increase of 2% to reach HUF 20.2 billion while its EBITDA margin dropped from 5.4% to 5.1%. Thanks to the higher EBITDA the activity generated (+ HUF 3.6 billion), the transaction effect of the Mobility Services Business Unit played a significant role in increasing the EBITDA. In 2024, the company’s total comprehensive income was HUF 7.5 billion (-22%) with earnings per share at HUF 12.8 (-40%). The cost of goods sold (CoGS) increased to a lesser degree than revenue, namely by 7 percent to reach HUF 327 billion, meaning the Group was able to increase its margin-generating capacity from 16.6% in the base period to 17.9%, largely thanks to the beneficial changes in the Jaguar and Land Rover brand’s price and model mix. The 31% increase in personnel expenses is primarily attributable to the growth in staff numbers due to acquisitions closed in 2023 and 2024, to wage increases driven by labor market changes, and the organizational developments related to group management and integration (the Group’s average headcount grew by 339 to reach 1323 persons). In 2024, the value of financial gains or losses was HUF -5.7 billion after 2023’s figure of HUF -4.4 billion. This growth is primarily due to the exchange rate losses realized and unrealized due to the substantial weakening of the HUF. The decrease in interest expenses and income compared to 2023 is due to the lower interest environment and the investment of the increased amount of the Group’s available cash balances.

* Vehicle market data by ACEA.

** Market data by DataHouse.

*** Starting from 2024, mobility-related services such as short and long-term vehicle rentals, fleet management, and car sharing have been moved to a new business unit since their importance grew in part due to the acquisitions (of wigo fleet, formerly Nelson Flottalízing and wigo carsharing) closed in 2023. The data pertaining to the Mobility Services Business Unit had previously been reported as part of the Retail Business Unit.

AutoWallis Group closed 2024 with growth and stable profits even in a variable environment

Latest news

AutoWallis Group’s revenue increased by 20% in 2025, with international markets accounting for an increasing share

2026.02.27.

Tibor Veres wins EY ‘Entrepreneur Of The Year’ award in Hungary

2026.02.23.

Number of voting rights, composition of share capital 31.01.2026

2026.02.02.

Four analysts recommend AutoWallis shares for purchase with a consensus target price of HUF 200

2026.01.27.

AutoWallis opened the first NIO dealership in Hungary

2026.01.23.